how do i change my bank account with social security

When you lot're looking for details, start your search here. You need the right information to make important financial decisions, and we're committed to delivering.

Account Rest

First Bank makes checking your balance easy- anywhere, whatsoever fourth dimension. Click the characteristic to acquire more than.

ebanking

Log in to your online business relationship from www.First.Bank.

Account balances are displayed on the Financial Center. Click on an account to view transaction history.

Mobile Cyberbanking

Open up the Start Depository financial institution on the Go mobile app, enter your quick access code, Face ID, or login credentials to view your remainder.

Use with iPhone, iPad, or Android phones and Android tablets, as well as many other mobile devices.

*Must have a prior eBanking registration. Click here to register.

Automated Banking

- Phone call 800-760-2265, Cull Option ii

- Select Option i

- Select Choice 1

- Choose your account blazon: 1 for Checking, two for Savings, 3 for Money Market, iv for Certificate of Eolith

- Enter your full account number

- Enter your Personal Identification Number (PIN) to hear your residual

Text Banking

Text 'B' to 49794. You will receive a text bulletin with the available balance on your accounts.

To enroll for Text Banking, login to your eBanking account from www.Showtime.Banking concern. From the Customer Service tab, cull 'Manage mobile banking settings'. Provide your mobile carrier and mobile telephone number to register.

Alerts

Create a balance warning to be sent daily or weekly past email or text bulletin.

To ready an alarm, log in to your eBanking via world wide web.First.Banking concern. From the Customer Service tab, choose "Manage alerts'. Nether Account Alerts, cull 'Add' next to Account Residual. Choose the frequency and the contact method for your alert.

ATM/ITM

Access your account at any ATM/ITM and cull the 'Residue Research' option from the carte du jour. Click hither for First Bank locations.

The current remainder is the total amount of money in your business relationship before whatsoever awaiting activity or holds. This balance is updated at the first of each business day.

The bachelor balance is the corporeality available for use. The available residual reflects pending items and items on hold, and may change throughout the twenty-four hour period.

Please note that some transactions may not be reflected in your available balance. That may include, but is non express to:

- Debit menu authorizations/ pay at the pump transactions

- Tips added to your purchase amount

- Checks that have non been cashed

- Automatic payments and pecker payments scheduled for time to come dates

- Eolith holds

Your business relationship is overdrawn because a transaction has caused the Available Balance on your account to get a negative amount or a transaction has occurred while the Available Balance on the account was negative. Please contact our Start Bank Service Centre at i-800-760-2265 option 2 for more specific assistance regarding your overdrawn business relationship.

Account Number

- The account number is located at the bottom of a check or deposit slip

- On a cheque prototype in your online business relationship history.

- By logging into your account at world wide web.Showtime.Depository financial institution. (From the Financial Center, click on the business relationship y'all would like to view. In the pop-upwardly, become to the 'Account Information' tab. Hover over the "eyeball" to show the full business relationship number.) Start Banking company checking and savings account numbers are x digits long. *IPhone and IPad users—please notation that the total account and routing numbers will not brandish in the mobile browser. Nosotros recommend using a PC to obtain the information.

- Contact united states at 800-760-2265 or visit your local branch/ITM.

Bill Pay

Login to your eBanking account. Click on the "Pay and Transfer tab" at the top of the folio. Click on "Pay Bills". For a tutorial, watch this video.

For complete beak pay instructions, click hither.

A bill payment is either sent electronically or by check. You are able to verify the method of payment by going to 'View Payment History' for the payee and selecting 'Payment details' next to the payment you are inquiring about. The payment type volition be listed every bit Electronic or Check, with the check number. The evangelize by date is the expected date for the merchant to receive the payment. Check payments are sent 3-four business days prior to the payment date.

*Not all payees will receive an electronic payment. A payee must have an agreement with the bill pay vendor to receive electronic transfers. If no understanding is in place, a check will be sent.

For electronic payments, a proof of payment service request will demand to be opened by a FBSC agent. Our bill pay team will contact the payee to provide the tracking and account data to assist with locating the payment. For check payments- Please verify the mailing address for the payee. If the payment appears to be lost, a finish payment tin be placed on a lost check at no fee.

Business Mobile App

Client may find how to annals by visiting Business Mobile eBanking OR visit the app shop on their mobile device and search forFirst Depository financial institution Biz to Become.

Cards and Digital Wallet

First Bank Debit Cards have a $2,000.00 buy limit. If you lot need to make a purchase over this corporeality, please contact the Beginning Bank Service Center at i-800-760-2265 choice 2.

Please contact the Outset Bank Service Center at 1-800-760-2265 option ii to raise the purchase limit on your debit card.

You may actuate your personal debit card by making a purchase or withdrawal using your Pivot number. Business clients may activate their cards past calling i-800-757-9848 from the phone number associated with their account.

Please contact our First Bank Service Center at 1-800-760-2265 choice 2 or your local co-operative to get a dispute started on an unauthorized debit card accuse. Visit our Locations page to find a local co-operative closest to you.

Please contact our First Banking concern Service Middle at 1-800-760-2265 pick two or your local branch during normal business hours to study a card lost or stolen. After hours and on weekends, please contact our menu monitoring company at 1-800-262-2024.

You may reset the PIN number on your First Depository financial institution Debit Carte du jour by going through our Automated Telephone Banking Organisation. Please contact the First Bank Service Center at ane-800-760-2265 option 2 if you lot accept whatever problems or demand assistance getting this information reset.

Yeah, please visit our Credit Cards page to learn more and make full out an application online.

Checking

ane. To help the government fight the funding of terrorism and coin laundering activities, Federal police requires united states to obtain, verify, and record information that identifies each person interim equally an authorized signer or is a Beneficial Owner of the entity. When you apply for an account, we will ask for the proper noun, residential accost, appointment of nascency and other information that volition allow us to identify those individuals designated equally authorized signers and Beneficial Owners. In addition, nosotros volition crave a valid (unexpired) Chief Identification for each individual.

Acceptable Primary Identification

- U.S. Driver'south License

- U.S. Country ID

- U.S. War machine ID

- Resident Alien/Permanent Resident Bill of fare

- Passport

- Matricula Consular ID Card

- Republic of guatemala Consular ID Card

- U.S. Visa Border Crossing Card

Annotation: If the address on the Main ID is not the individual's current residential accost, or the ID does not brandish a residential address, a passport for instance, boosted documentation is required to show the current residential address. This might include, but is non express to, a utility beak or lease.

2. Data regarding the individual Benign Owners of the business concern. Beneficial Owners are those who own, directly or indirectly, 25% or more of the disinterestedness interests of the business. This information is collected to help fight financial crime.

3. Registration documents from the state where you registered your business in addition to documentation regarding the type of business organisation entity yous own. Contact your local First Bank branch for further information.

The interest rate will display every bit 0.00% considering the rate plan for this product is in two dissimilar tiers. Meet Product Rate Sheet for the current Interest Rates.

To assistance the government fight the funding of terrorism and money laundering activities, Federal law requires us to obtain, verify, and record information that identifies each person who opens an account. When you lot utilise for an account, nosotros will ask for your proper name, residential address, date of nativity and other information that volition allow us to place yous. In add-on, we will require a valid (unexpired) Primary Identification.

Acceptable Chief Identification

- U.S. Driver'southward License

- U.S. State ID

- U.S. Armed forces ID

- Resident Alien/Permanent Resident Card

- Passport

- Matricula Consular ID Menu

- Republic of guatemala Consular ID Card

- U.S. Visa Edge Crossing Bill of fare

For minors, Driver's Permit with moving picture; Birth Certificate when other forms of ID are not available.

Note: If the address on the Primary ID is not the individual'southward electric current residential accost, or the ID does not brandish a residential address, a passport for instance, additional documentation is required to show the current residential address. This might include, just is not express to, a utility bill or charter.

You may find out who a bank check was written to by viewing the check through eBanking, contacting your local branch, or calling the First Bank Service Center at ane-800-760-2265 option 2.

You may view an image of your check through your eBanking by clicking on the check number itself. If you have a check number which may have already cleared your business relationship, the only prototype you volition be able to see is that first particular which cleared.

Digital Wallet

Start Banking company currently supports: Apple, Google, and Samsung pay Digital Wallet services. Please visit our Digital Wallet page for more information regarding each service.

eStatements

Personal

Signing upwards for eStatements is fast, easy, and secure! Simply login to eBanking. Under the "Accounts" tab, click on Statements. And then, click the "eStatements" option.

Contact a Showtime Bank Service Representative at 800-760-2265 Monday-Sabbatum 7a.m.-9p.m. CST, Saturday 9a.one thousand – five:30p.m. CST

Business

Simply login to Business concern eBanking and click through the post-obit steps:

- Reports

- Online Documents

- Statements & documents

- View and maintain certificate preferences

Contact Treasury Management Client support for assistance at 866-326-7113 Mon - Friday 7 a.grand. - 6 p.m. CST.

No, eStatements are Gratuitous! All the same, if your eStatements include images of your checks, at that place will be a monthly fee for this service. See below for additional information. If yous would like to opt out of bank check images on your eStatements, please contact the Customer Contact Middle 800-760-2265 or for businesses, Treasury Management Customer Support at 866-326-7113.

Consumers

- eStatements - Gratuitous

- eStatements with check images - $one.00 per month

- Paper Argument with no check images - $two.00 per month

- Paper Statement with check images - $3.00 per month

Business

- eStatements - Free

- Paper Statements - $five.00 per month

You may elect to begin receiving your paper statement again at any time.

Fraud Prevention

Monitor your online depository financial institution accounts for debits, credits, check orders, and new payees and accounts that you don't recognize. If something doesn't expect familiar, contact the First Bank Service Center at 1-800-760-2265.

General Account Information

Please contact our First Bank Service Middle at 1-800-760-2265 option 2 for any questions you may take regarding not being able to hear/run across an account.

First Bank policy states that your signature is required to update an address on your account. You may obtain an Authorization for Change form by visiting your local co-operative, through your eBanking secure postal service message, or past contacting our First Banking company Service Center at 1-800-760-2265 pick 2.

You may visit any local co-operative in person to close your account. Click here to find a co-operative closest to you lot. If you are non able to visit a branch in person, you lot may send a notarized letter to a branch indicating yous would similar the business relationship to exist closed and whatever remaining funds volition exist mailed to you.

The deposit is posted on the constructive date provided by the depositor. Holds are not placed on electronic funds.

Check orders can exist placed through the Customer Service tab of your eBanking login or contact u.s. at 800-760-2265 to place an order.

Check- You may identify a stop payment on a check through the Customer Service tab of your eBanking login or by contacting us at 800-760-2265.

Electronic Debit (ACH) - Please contact us at 800-760-2265 to request a finish payment.

Debit Card – Please contact us at 800-760-2265 for further information.

The interest rate will display as 0.00% because the rate plan has two dissimilar tiers based on the account residue. View the Product Charge per unit Sheet for current Interest Rates.

- Check images are available for 6 months on your eBanking login.

- Check images are bachelor on your argument. The fee for images on the argument is $1 per month (consumer accounts). Contact us at 800-760-2265 to setup this service.

Checking and Money Market: Monthly

Savings: Quarterly, unless there is electronic activity. Then a monthly argument will be created.

IRA: Annually

CDs: Monthly accounts statements are not produced.

*Customers with multiple accounts who receive a newspaper statement are eligible for a combined statement. This offers the convenience of getting all your account data at one time, on one statement. Contact us at 800-760-2265 to request a combined statement.

General Savings

First Bank offers a diverseness of ways for you to invest and lookout your money grow. Compare our consumer savings accounts and select the account that is correct for you.

Savings and money market deposit accounts can exist opened with as little as $100.

Monthly statements are mailed to customers with checking and/or coin market place accounts. More often than not, customers with savings accounts are sent quarterly statements, while those customers with electronic activity will receive a monthly statement. Statements on IRAs are sent annually at year-terminate. Customers with certificates of deposits are not sent statements, though they do receive a observe when involvement has been paid on their account or prior to the business relationship maturing. Customers with multiple accounts may be eligible to receive a combined argument. This offers you the convenience of getting all your account data at one time.

Mobile Banking

Starting time Banking concern currently supports: Apple, Google, and Samsung pay Digital Wallet services. Please visit our Digital Wallet page for more than information regarding each service.

Customer may register for the Mobile App by clicking here and choosing the app links OR they may get to the app store on their mobile device and search for Commencement Bank On the Go.

Yes! Clients tin can utilise both the Text Banking and the Mobile App at the aforementioned time.

Clients volition demand to use a spider web browser to log in with a temporary password. The Mobile App will not allow you to log in with a temporary password.

Clients who have had an account open for longer than 60 days are able to set up and use Mobile Deposit. In one case the client has been registered for the appropriate amount of time, the option will announced and the customer will follow the prompts and directions to use the service.

Mortgage

Knowing in advance how to get a mortgage is an essential first step in the home buying process. First Banking concern Mortgage is a trusted and experienced mortgage lender and can hands assist you throughout the process. Before you decide to purchase your first home, advisedly appraise your own financial situation. Whether yous're married or single, you'll need to decide where you stand up financially. For case, practise you know your credit score? What are your electric current balances on unsecured personal loans, like credit cards and student loans? First Bank Mortgage does offering several programs for beginning-fourth dimension homebuyers needing little money down; all the same, strive to have cash on mitt, or in reserves, to utilize for whatsoever potential downwardly payment, utilities, moving expenses, new home furnishings, or unforeseen emergencies. To assist guide you through the home loan procedure, contact a Offset Depository financial institution Mortgage Habitation Loan Advisor. One of our friendly team members can assist yous determine the type of mortgage and loan amount that's comfortable for you, based on your private fiscal position.

A fixed rate mortgage is just that, it has a fixed involvement rate. Meaning, the involvement charge per unit does not modify throughout the life of your loan, allowing your master and interest payment (P & I) to remain the same. However, with an adjustable rate mortgage, the involvement charge per unit may vary based on changes in market conditions (up or downward). It'south important to know there is usually a cap on adjustable rate changes, protecting the borrower from the rate (and the corresponding payment) going up too high. Since there's the potential for an increase in your payment to occur, an adjustable charge per unit mortgage tends to come with a higher risk. Carefully assess your personal financial state of affairs to determine which is right for you.

Yes, it's possible for your payment to change. If this occurred, it would be due to any fluctuations in the annual tax assessments to your property or any increase to your homeowner's insurance policy. Since both are paid monthly through your mortgage payment, whatever changes to either of these items would alter your payment. Please annotation, with a fixed rate home mortgage, your main and involvement payments will remain the aforementioned throughout the life of your loan.

It would be nice to await for a lower rate; yet, at the same time, the price of the dwelling house can too increase. If you lot are ready to buy, that is normally the time you should buy! Showtime Depository financial institution is always ready to assistance you lot in the well-nigh important purchase of your life - owning your own home. Experience free to call upon any of our loan advisors to respond your questions and put you on the road to home ownership!

This is a legally binding agreement betwixt buyer and seller which, when accepted by all parties, confirms the purchase price of the belongings. Usually, the buyer places a small-scale amount of money in eolith as good faith (called "earnest money"). You should not sign a sales contract unless you have reviewed it carefully and perhaps even had it reviewed past an attorney. A contract is ofttimes contingent upon many things, such as mortgage loan approval, inspections of well and/or septic systems, satisfactory building inspection, and termite inspection. You should make sure your ain rights are protected.

At that place are many acceptable sources of funds that y'all can use for a downward payment. The most common are: personal savings or checking business relationship, gift from a family member, 401(thousand) business relationship, and down payment assist programs. A Mortgage Habitation Loan Counselor is at that place to assist you lot with these options and more.

A general dominion of thumb for determining if you can qualify for a new mortgage is to employ 33% of your gross monthly income for housing. The housing payment includes the monthly principal and involvement on the mortgage, plus the property taxes and homeowners insurance. It is a good thought to besides consider all the monthly amounts for car payments, leases, and revolving credit cards, plus the new housing payment at 38% of your gross monthly income. Our Mortgage Home Loan Advisors can easily help yous to ensure you are able to authorize for the home you lot are considering purchasing.

Getting a mortgage tin can seem a fleck overwhelming. Using our online application, you accept the ability to expedite the procedure and easily upload all your banking and income documents. Your Mortgage Domicile Loan Advisor will help your abode loan experience go smoothly.

While it seems like one extra unnecessary step, a pre-approval strengthens any offer you lot make once y'all have decided on a home to purchase.

Generally y'all will need plenty funds for your down payment, closing costs and 2 months of your new payment in reserves.

I-Time Security Code

It is a randomly generated i-fourth dimension code we provide. You enter information technology before completing certain transactions to prevent fraudulent transactions and unauthorized admission to your fiscal information.

It is an extra layer of online banking protection that ensures that your funds and financial information are safe. By requiring the entry of a one-time code and the employ of a phone yous accept on record with us, fraud is prevented even if an unauthorized user learns your online banking user ID and countersign. Information technology also ensures that you lot are notified if an unauthorized user attempts to access your account information or complete transactions without your knowledge.

It is easy! We'll requite you the one-time code and you are asked to enter it when nosotros telephone call a number you have on record with the states.

No. In one case the code is entered, it is not needed again.

Personal eBanking

Please contact our Offset Bank Service Center at 1-800-760-2265 option 2 for any questions y'all may have regarding not beingness able to hear/see an business relationship.

Clients may update their password by choosing the Forgot Password link or past contacting the Start Bank Service Eye at ane-800-760-2265.

Personal

Signing upward for eStatements is fast, piece of cake, and secure! Simply login to eBanking. Under the "Accounts" tab, click on Statements. Then, click the "eStatements" selection.

Contact a Showtime Banking company Service Representative at 800-760-2265 Monday-Sat 7a.m.-9p.m. CST, Saturday 9a.m – 5:30p.m. CST

Business

Simply login to Business organisation eBanking and click through the following steps:

- Reports

- Online Documents

- Statements & documents

- View and maintain certificate preferences

Contact Treasury Management Customer support for assistance at 866-326-7113 Monday - Friday vii a.m. - 6 p.1000. CST.

No, eStatements are Costless! However, if your eStatements include images of your checks, in that location will be a monthly fee for this service. Run across below for additional information. If you would like to opt out of check images on your eStatements, delight contact the Client Contact Center 800-760-2265 or for businesses, Treasury Management Customer Support at 866-326-7113.

Consumers

- eStatements - Gratis

- eStatements with check images - $1.00 per month

- Newspaper Statement with no bank check images - $2.00 per month

- Paper Argument with check images - $three.00 per month

Business organisation

- eStatements - Gratuitous

- Paper Statements - $v.00 per month

Clients will need to employ a web browser to log in with a temporary countersign. The Mobile App volition not allow you to log in with a temporary password.

If the phone numbers listed are incorrect, delight check your log in information for accurateness. If it is correct, please contact a First Bank Service Center Rep at one-800-760-2265 to further troubleshoot this outcome.

You may elect to begin receiving your paper statement again at any time.

Verify that you are using the correct user ID and password combination. If the telephone number doesn't match when y'all attempt to exercise the One-Time Passcode (OTP), the chances are that one of the pieces (user ID or password) is non being entered in correctly.

Clients can view and alter alert preferences by choosing the Customer Service/Manage Alerts selection.

Clients are able to download upward to 500 completed transactions or 45 days' worth of business relationship activity for the post-obit file types: Quicken, QIF (Microsoft Money or Quicken 2004 and previous), CSV (can be used by whatsoever spreadsheet plan). *Note* QuickBooks is NOT supported on Consumer eBanking at this time.

People Pay allows the client to transfer money to other people or accounts the client is non attached to. External Transfer is used to transfer money between accounts the client is listed on as an authorized signer at a different financial institution.

At that place is a $0.l transaction fee for all People Pay payments. External Transfers likewise accept a $0.l fee per transfer outside of Kickoff Bank. External Transfers coming INTO First Bank practise not take a fee.

RTP Network

The Real-Time payment (RTP) Network allows a sender to transfer payment to receiver within seconds. Information technology is a new payment rail similar to ACH, Wires, or Credit Card developed past TCH (The Clearing House), using the latest standards to accost the increased demand for faster and safer payment transfer. The network will clear and settle payments 24-hours a day, seven days a calendar week, and every day of the year.

Built for the digital age, all federally-insured U.S. depository institutions are eligible to utilise the RTP Network.

Yes, Get-go Banking company is proud to now participate in the RTP Network equally a receiving bank.

RTP provides access to funds credited to your account within seconds. It likewise provides the ability to receive remittance data virtually the eolith forth with the transfer and utilize new dual communication methods to ensure condom transfer between the payee and the payor.

RTP transactions are sent individually round the clock (24x7x365) whereas ACH transactions are batched upwardly and ordinarily processed a few times a day for both same day ACH transactions as well as future dated transactions on business days just. ACH originators can both push (transport) and pull money (receive) whereas RTP originators tin push (send).

Absolutely. RTP is processed through secure banking channels with high security protocols.

But provide your account and routing numbers to any of your payees who accept the ability to originate an RTP transaction. Much similar any digital transaction, you will see details of the RTP deposit on your eBanking dashboard, Mobile Cyberbanking app, or on your banking argument.

RTP is a totally new existent-time network that authenticates a transfer using the account number and banking company routing number instead of an e-mail address or mobile number. This eliminates the need for a separate sign up to identify the recipient. Zelle runs on a combination of the card and ACH networks. Notation: First Bank is setup to receive Zelle payments and RTP Payments. Zelle is limited to consumers with an active First Banking company Debit Card, and RTP is available to all businesses and consumers with an agile Kickoff Bank Checking, Savings, or Money Market place account.

Start Bank joined the RTP Network every bit a receiving bank in 2022 and our programme is to also be a sending bank in 2022.

Tax Statements

1099/1098 Statements are mailed by Jan 31.

Consumers receive 1099-INT Statements if the total interest of all of their accounts, in which their social security number is listed as the chief possessor, equaled $10 or more during the tax year.

Business organization accounts exercise non receive a 1099-INT Statement.

1098 Statements are sent to those individuals with real estate secured loans that have paid $600 or more of interest during the taxation twelvemonth.

1098 Statements are not produced for corporations, partnerships, trusts, estates, associations, or companies (other than sole proprietorships).

If a distribution occurred during the tax yr on your IRA, you will receive a 1099-R Argument.

No, the interest earned on an IRA is non-taxable.

The information on a 5498 Statement is submitted past the issuer of your IRA to report contributions, including any catch upwards contributions, rollovers, direct rollovers, recharacterizations, and conversions, as well every bit the Fair Market Value (balance as of Dec 31) for each person who maintained an IRA the prior calendar year. The 5498 Statements are mailed prior to May 31st.

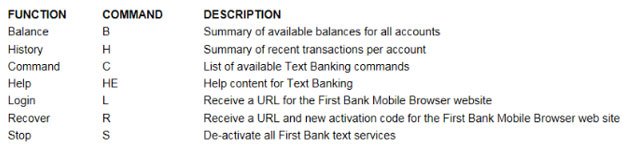

Text Banking

Clients can employ the following list of text commands:

Yes! Clients tin utilize both the Text Banking and the Mobile App at the same time.

Transfers

To transfer betwixt your personal accounts:

ane) eBanking under 'pay and transfer'

2) Automated Banking

- Call 800-760-2265, Choose Option 2

- Select Pick i

- Select Option 2

iii) At a Start Banking concern ITM with a Virtual Banker

4) At a Commencement Bank ATM betwixt primary linked accounts

5) By contacting us at 800-760-2265

- From your personal business relationship to your account at another institution: utilize the 'External Transfer' selection under the Pay and Transfer tab of eBanking.

- To transfer to some other person: utilize People Pay nether the Pay and Transfer tab of eBanking. The fee for a People Pay transfer is $0.l.

- You may also visit a Starting time Bank location to asking a wire transfer. For wire instructions, click here.

- Write a bank check to yourself from the business concern business relationship and complete a mobile deposit into your personal account through the Kickoff Banking concern on the Become app

- Visit your local branch or ITM during business hours

You may transfer funds into an business relationship that you lot are not on by utilizing our Popular Coin or Move Money features in Nib Pay or by visiting your local co-operative.

Update Business relationship

- Contact us at 800-760-2265

- Visit your local branch

- Send a secure message through your eBanking login requesting a modify

Please visit your local co-operative to asking a name alter. Delight bring a copy of your marriage license or divorce decree along with an updated principal identification.

To remove a deceased owner: Delight bring a decease certificate into your local branch.

To remove a joint owner after divorce/separation: A living possessor may non be removed from an account. The business relationship should be closed and a new account opened. Either owner may request the account closure.

To add an owner: Please visit a local Outset Bank branch with the new account owner. He or she should bring a primary grade of ID. 'primary form of id hyperlink to beneath question outlining accustomed forms of id'

To add or remove an authorized signer from a business business relationship: A copy of the coming together minutes authorizing this change and signed by the secretary of the corporation is required to add or remove a signer. When adding a signer, he or she must present valid identification.

Add together a trust to an account

Delight provide the required documentation:

- Copy of the page of the trust indicating the name of the trust

- Copy of the page of the trust showing the grantors and trustees

- If at that place are multiple trustees named- the page(s) of the trust documenting that the trustees may work separately, forth with the notarized page signed past the grantors.

Add a trustee

Please provide the required documentation:

- Re-create of the folio(s) stating that the grantor or trustee may add another trustee. If there are multiple trustees, the folio(s) of the trust documenting that the trustees may work separately must also be provided.

Remove a trustee due to incapacity or disability

Please provide the required documentation:

- Copy of the page(southward) of the trust that define the documentation required to support incapacity/disability.

- Documentation required equally indicated in the trust

- Copy of the folio(due south) of the trust indicating that the trustees may work separately

Remove a trustee due to death

Please provide the required documentation:

- Certified re-create of the death certificate

- If the removal of the deceased trustee requires the appointment of a successor trustee or trustees, the folio(s) identifying the successor(s). If there are multiple successor trustees named, the page(s) indicating that the trustees may work separately is required.

Remove a trustee due to resignation

Please provide the required documentation:

- A notarized letter of resignation

- If the removal of the deceased trustee requires the appointment of a successor trustee or trustees, the page(s) identifying the successor(s). If there are multiple successor trustees named, the page(south) indicating that the trustees may work separately is required.

For business relationship owners xviii years and older:

- U.Due south. Driver'southward License

- U.S. State ID

- U.Due south. Military ID

- Resident Alien/Permanent Resident Card

- Passport or U.S. Passport carte

- Matricula or Guatemala Consular Carte

- U.Southward. Visa Edge Crossing Card

For account owners age xiii-17, aforementioned as listed above if available or :

- Birth certificate (if other forms of ID are not available)

- Driver's permit (must include moving-picture show)

Update Contact Information

- Through the Customer Service tab of your eBanking login

- Visit a local First Banking company co-operative or ITM during business organisation hours

- Contact us at 800-760-2265.

Source: https://first.bank/Resources/Learn/FAQs

Posted by: mathewssuraing.blogspot.com

0 Response to "how do i change my bank account with social security"

Post a Comment